Textile Exports Show Strong Performance in 2024

In 2024, despite facing numerous challenges, China’s textile foreign trade continued to exhibit strong growth momentum.

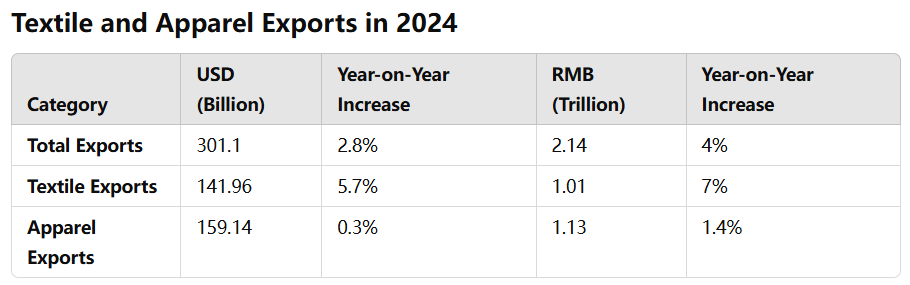

According to data from the General Administration of Customs, China's textile and apparel exports in 2024 reached USD 301.1 billion, surpassing the USD 300 billion mark again, with a year-on-year increase of 2.8%. Of this, textile exports amounted to USD 141.96 billion, a year-on-year increase of 5.7%, while apparel exports were USD 159.14 billion, a year-on-year increase of 0.3%.

In RMB terms, textile and apparel exports totaled 2.14 trillion yuan, marking a 4% year-on-year increase. Among them, textile exports were 1.01 trillion yuan, and apparel exports were 113 billion yuan, increasing by 7% and 1.4% year-on-year, respectively.

Looking ahead to 2025, international organizations generally predict that global economic growth will remain in the range of 2.7% to 3.3%, which is relatively stable compared to 2024, but with a slowing trend. The international trade environment still faces many uncertainties, with high risks from geopolitical conflicts and trade protectionism, especially concerning U.S. trade policies, which pose significant challenges to China's textile industry.

As a result, textile foreign trade urgently needs a new growth engine, and Xiaohongshu, which recently made a splash internationally, may become a new opportunity for textile businesses to expand overseas.

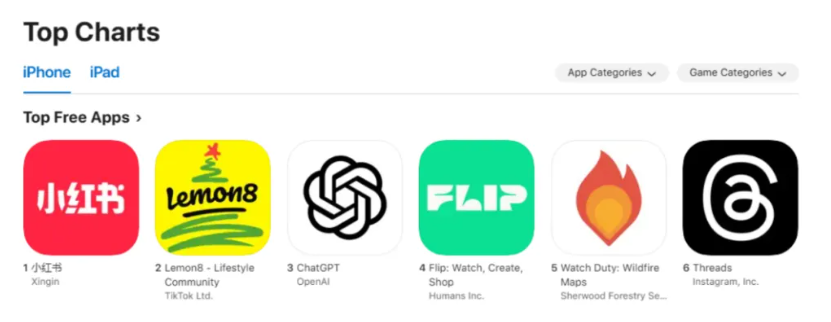

On January 14, as U.S. users grew increasingly concerned about a potential TikTok ban, another popular Chinese social media app, RedNote (the international version of Xiaohongshu), quickly went viral in the U.S., topping the Apple App Store download charts, followed by TikTok’s photo-sharing app, Lemon8, and OpenAI's ChatGPT.

Reports indicate that many American users posted photos and videos of their daily lives on Xiaohongshu, referring to themselves as "TikTok refugees" and explaining why they switched to Xiaohongshu. This shift was driven by the U.S. government’s demand that ByteDance, TikTok’s parent company, divest TikTok by January 19 on national security grounds, or face a potential ban.

The influx of U.S. users was unexpected. When Chinese netizens opened Xiaohongshu, the screen was filled with English posts from U.S.-based IP addresses. Chinese users were left confused: "Who am I? Where am I?" Everywhere they looked, there was a "foreigner," forcing them into "English reading comprehension mode."

According to Jiemian News, this surge in U.S. users will help Xiaohongshu further expand its overseas user base and international market share, laying the foundation for enhancing its global influence, promoting cultural exchange between China and the U.S., and opening up more commercial opportunities. Could this be the new overseas business opportunity?

Recently, while using Xiaohongshu, the author noticed a marked difference in the user experience compared to before—an influx of overseas bloggers. Thanks to advanced translation tools and the growing prevalence of English in China, communication between the two sides faced minimal barriers.

The first wave of American users who joined Xiaohongshu were often content creators and self-media professionals, naturally attracting traffic and thus encouraging more users to settle on the platform.

In fact, with the rapid development of the new media industry, Xiaohongshu has become a marketing hub for many textile and apparel companies. However, due to the current “overwhelming traffic,” it allows for direct communication between real overseas users and domestic businesses, offering an ecosystem and positioning that is unparalleled by other platforms. It can truly be considered a "blue ocean."

For example, a popular topic on Xiaohongshu recently has been the exchange of living habits and living costs between China and the U.S., which presents a great opportunity for promotion. Today, China's textile industry has made remarkable strides in production, technology, and design, and thanks to its unique industrial chain advantages, it offers high-quality products at competitive prices. With the influx of numerous overseas users, China’s textile industry may seize the cross-border e-commerce opportunity.

Additionally, many textile companies are using platforms like Xiaohongshu to build their brands. In the past, these companies primarily targeted domestic consumers, with overseas marketing costs being prohibitively high. However, Xiaohongshu now provides a cost-effective channel for engaging with overseas consumers, helping textile companies expand their global influence.

QR CODE

QR CODE